IMF Staff Completes 2024 Article IV Mission to Zimbabwe

End-of-Mission press releases include statements of IMF staff teams that convey preliminary findings after a visit to a country. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF’s Executive Board for discussions and decision.

Harare: In light of new policy developments, an International Monetary Fund (IMF) staff team led by Mr. Wojciech Maliszewski conducted a second mission to Harare during June 18-27, 2024, to conclude the 2024 Article IV Consultation.

At the conclusion of the IMF mission, Mr. Maliszewski issued the following statement:

“Despite headwinds, Zimbabwe’s economy continues showing resilience. Growth is expected to decelerate to about 2 percent in 2024 (from 5.3 percent in 2023), as the country faces a devastating El Niño-induced drought. Higher import bills are also worsening the balance-of-payments outlook. But growth is expected to recover strongly in 2025 to about 6 percent, supported by a rebound in agriculture and ongoing capital projects in manufacturing.

“Against this background, the Reserve Bank of Zimbabwe (RBZ) introduced in April 2024 a new currency—the Zimbabwe Gold (ZiG). The ZiG official exchange rate has so far remained stable, ending a bout of macroeconomic instability in the first 3 months of the year (when the Zimbabwean dollar depreciated by about 260 percent). Assuming that macro-stabilization is sustained, cumulative inflation in the remainder of the year is projected at about 7 percent.

“The mission welcomes improvement in monetary policy discipline and recommends further refinements to the policy framework. Price stability would be best achieved by stabilizing the ZiG nominal exchange rate against a suitable basket of currencies (accounting for the dominant role of the USD in the economy). This could be in turn accomplished by controlling base money growth: for now through unremunerated Non-Negotiable Certificates of Deposits (NNCDs), but over time through indirect (interest-rate-based) monetary instruments to increase the attractiveness of the new currency. The exchange rate should be determined in a deeper market to provide relevant information in the decision regarding the monetary policy stance, which would require identifying and removing any remaining impediments to the functioning of the FX market to promote price discovery.

“Closing the fiscal financing gap is essential to sustainably stabilize the currency. The transfer of past debt obligations related to the RBZ’s quasi-fiscal operations (QFOs) to the Treasury represented an important step to strengthen financial discipline. The mission also welcomes enhanced coordination between the RBZ and the Ministry of Finance, Economic Development and Investment Promotion (MoFEDIP) on macro-policies and liquidity management. However, the mission assessed that the cost of servicing the QFO-related debt and T-bills (including about 8 percent of GDP issued last year), combined with weaker-than-expected revenues (despite strong efforts to raise them through policy measures) and drought-related spending, opened a sizeable financing gap in the 2024 budget. The financing gap would need to be closed in a way that does not undermine the monetary policy stance. The mission is encouraged that the work to identify such measures is ongoing and stands ready to provide support to the authorities as needed.

“Strengthened governance framework for the newly constituted Mutapa Investment Fund will be key for the stabilization effort. Steps to this end should include ensuring that the fund’s mandate is clearly defined and aligned with the National Development Strategy; enhancing its transparency and ensuring full integration in the budget process (Mutapa’s annual operating budget, capital investment, asset sales, and borrowing plans should be subject to approval by the MoFEDIP—financial management of public entities is already regulated by the Public Finance Management Act); and adhering to highest standards of corporate accountability.

State of the African digital economy

Africa’s digital economy is on a growing trend. This is a result of a combination of factors, from improved internet access and the presence of vibrant startup ecosystems to improvements in policy frameworks. But there are disparities between countries. For instance, when it comes to e-commerce readiness, South Africa scored 56.5 points in UNCTAD’s 2020 index, compared to only 5.6 for Niger.

In 2012, Africa’s digital economy was estimated at roughly 1.1%, or US$30 billion of its GDP.1 In 2020, estimates indicated a contribution of 4.5%, or US$115 billion. This growth is expected to continue in the coming years. A 2020 study by Google and the International Finance Corporation (IFC) found that the digital economy could contribute US$180 billion (5.2%) to the continent’s GDP by 2025, and US$712 (8.5%) billion by 2050 (Table 12). Reasons behind this estimated growth include better quality internet connectivity and improved access, vibrant startup ecosystems, growing tech talent pools, and improvements in policy and regulatory frameworks (including the launch of the African Continental Free Trade Area).

Analysing Your Online Success: Metrics and Measurement for South African Businesses

Analysing the success of your online efforts is crucial for South African businesses looking to improve their digital marketing strategy and achieve their business goals. By tracking and analysing key metrics, companies can gain insights into their customers’ behaviour, measure the effectiveness of their marketing campaigns, and make data-driven decisions to optimise their online presence. Let’s explore key metrics, and measurement strategies South African businesses can use to analyse their online success.

Website Analytics

Website Analytics

1. Website Traffic

Website traffic is a crucial metric for measuring the success of your online presence. You can gain insights into your customers’ behaviour and preferences by tracking the number of visitors to your website, where they’re coming from and how long they’re staying. Consider using tools like Google Analytics to track your website traffic and identify opportunities for improvement.

2. Conversion Rates

Conversion rates measure the number of visitors to your website who complete a specific action, such as making a purchase, filling out a contact form, or subscribing to a newsletter. By tracking your conversion rates, you can measure the effectiveness of your marketing campaigns and make adjustments to improve your results.

3. Social Media Engagement

Social media engagement measures how often your audience interacts with your brand on social media platforms. This can include likes, comments, shares, and mentions. By tracking social media engagement, you can gain insights into your audience’s preferences and interests and adjust your social media strategy accordingly.

4. Email Marketing Metrics

Email marketing metrics include measures such as open rates, click-through rates, and conversion rates. By tracking these metrics, you can gain insights into your email marketing campaigns’ effectiveness and identify improvement opportunities.

5. Search Engine Optimisation (SEO) Metrics

SEO metrics include keyword rankings, organic traffic, and backlinks. By tracking these metrics, you can gain insights into how well your website performs in search engine results and make adjustments to improve your rankings and drive more traffic to your website.

6. Pay-per-click (PPC) Metrics

PPC metrics include click-through rates, cost-per-click, and conversion rates. By tracking these metrics, you can gain insights into the effectiveness of your PPC campaigns and make adjustments to improve your results and maximise your ROI.

7. Customer Retention Metrics

Customer retention metrics include customer lifetime value, repeat purchase rate, and customer satisfaction. By tracking these metrics, you can gain insights into how well your business is retaining customers and identify opportunities for improvement in your customer experience.

8. Competitor Analysis

Competitor analysis involves analysing the online performance of your competitors to gain insights into their strategies and identify opportunities for improvement in your online presence. Consider tracking metrics such as website traffic, social media engagement, and your competitors’ keyword rankings to inform your strategy.

Initiating Africa’s next digital challenge: Addressing the gap in digital marketing skills

The past decade has been…disruptive, to say the least. Ten years ago, we couldn’t just Netflix and chill. Not everyone had smartphones, and data was jargon for geeks and techpreneurs.

It’s just over a decade ago that Bra Willy Seyama founded pan-African digital marketing consultancy eNitiate Integrated Solutions, with the aim of changing Africa’s digital story – and disrupting the way we look at data.

“As an analyst, I’m always looking at the data – but I also like to focus on the people behind the data, not just on an aggregate level, because people just don’t get it unless you take specific angles of the data; then it starts resonating,” he reckons.

When not focused on core business – helping brands to establish and develop their digital presence – Seyama plays around with data that resonates with current affairs and cultural issues, and has established a blog that differs from most.

“I get inspired by topical issues, trending topics, and I go and do the analyses,” he explains, referring to an entreaty he posted when Sho Madjozi hit the headlines with her hit song devoted to John Cena – Three Reasons Why Limpopo Province Must Leverage the Rising Star of Sho Madjozi – using an array of graphs and timelines to highlight how and why the government office could benefit from highlighting the successes of its citizens (which it later did, with the Ndlovu Youth Choir).

“Her music is not mainstream – not to me anyway – and I’ve been following her, though not closely, as she identifies as pan-African and wears her ‘Limpopo-ness’ on her sleeve, and that drew my attention. When she published a video on YouTube that was trending on Twitter, I decided to scratch the surface and see what happens… “

Seyama was working on a project about the nine premiers at the time, and realised that neither the premier of Limpopo nor the province itself was not as active on social media and that, he says, “just added the impetus”.

Though eNitiate’s core focus is on strategy, analytics and developing content that counts – “if we cannot count what we put out, we won’t put it out; before releasing content, we know what to expect in terms of engagement and reach” – Seyama’s passion is for plugging Africa’s digital marketing skills gap.

“Having failed to find information about an audit of the digital marketing skills for any of the African countries, we broadened the Google search, and this lead us to the Digital Marketing Skills Benchmark – the 2018 UK-based annual report. The report tests for levels of competency across 12 skills. Just under 5 000 respondents participated in the latest online research, and they included executives and entry-level Marketers. The survey was also open to all sectors.

“But to our dismay, we could not find any related information for Africa in this regard – not even for South Africa,” he explains.

No digital marketing skills benchmarks

“Africa does not have digital marketing skill benchmarks. And while it is common knowledge that there is a digital marketing skills gap on the continent, there is not much information available on the size of the gap,” he notes.

“In this era of 4IR where digital technology is playing such a dominant role, it’s concerning that Africa does not have comprehensive information on required digital marketing skills. In this age of digital, this must also be concerning to all brand owners, marketers, communicators and talent managers alike.”

Seyama’s solution is to implement a continent-wide digital marketing skills audit, “to minimise the opportunity costs of doing digital marketing wrong – and to assess the current skill levels on the continent.

Launched end November, the inaugural Digital Marketing Skills in Africa Audit 2020 is supported by the Marketing Association of South Africa and championed by three African countries: Nigeria, Kenya and South Africa. The audit, in the form of an online survey, targets professionals in the digital marketing and communications community across the continent, “with a view to using the results to establish and continuously review the necessary benchmarks,” says Seyama.

The online survey will close on 31 January 2020, with a comprehensive report published by end March 2020.

Doing Business Online in Africa: Opportunities and Challenges

The digital landscape in Africa is rapidly evolving, creating significant opportunities for businesses to expand their reach and tap into new markets. The rise of internet connectivity, mobile penetration, and e-commerce platforms has enabled companies to operate online, offering goods and services to a broader audience. This article explores the current state of online business in Africa, the potential opportunities it presents, and the challenges that need to be addressed.

The Growth of Online Business in Africa

Over the past decade, Africa has witnessed substantial growth in internet and mobile phone usage. According to the International Telecommunication Union (ITU), internet penetration in Africa has been steadily increasing, with a significant portion of the population now connected to the digital world. This growth has been fueled by the expansion of mobile networks, the proliferation of affordable smartphones, and efforts to improve internet infrastructure.

The e-commerce sector, in particular, has seen remarkable growth. Platforms like Jumia, Takealot, and Konga have become household names, providing consumers with access to a wide range of products and services. Additionally, social media platforms like Facebook, Instagram, and WhatsApp have become vital tools for businesses to reach and engage with customers.

Opportunities for Online Business in Africa

- E-commerce and Retail E-commerce presents a significant opportunity for businesses in Africa. The convenience of online shopping, coupled with a growing middle class, has led to increased demand for online retail. Businesses can leverage e-commerce platforms to sell products ranging from fashion and electronics to groceries and beauty products. Additionally, the rise of digital payment systems like M-Pesa, Flutterwave, and Paystack has made online transactions more accessible and secure.

- Digital Services The digital economy in Africa is not limited to physical products. There is a growing market for digital services, including online education, entertainment, telemedicine, and professional services. For example, online learning platforms like Udemy and Coursera have gained popularity, providing access to a wide range of courses and skills training. Similarly, telemedicine services have become crucial in providing healthcare access, especially in remote areas.

- Financial Technology (Fintech) The fintech sector is booming in Africa, with innovative solutions addressing the continent's unique financial challenges. Mobile money services, digital banking, and cryptocurrency exchanges are transforming how people manage their finances. Startups like Chipper Cash, Fawry, and Tala are offering innovative solutions for payments, savings, lending, and investments. The fintech industry is not only improving financial inclusion but also offering new business opportunities for entrepreneurs.

- Content Creation and Digital Marketing The rise of digital media has created a demand for content creators and digital marketing professionals. Social media influencers, bloggers, vloggers, and podcasters are leveraging platforms like YouTube, TikTok, and Instagram to create and monetize content. Businesses are increasingly investing in digital marketing to reach their target audiences, using strategies like search engine optimization (SEO), social media marketing, and influencer partnerships.

Challenges of Doing Business Online in Africa

- Infrastructure and Connectivity While internet penetration is increasing, infrastructure remains a challenge in many parts of Africa. Poor connectivity, limited broadband coverage, and high data costs can hinder access to online services. Efforts to improve digital infrastructure, including expanding broadband networks and reducing data costs, are essential for the growth of online business.

- Payment Systems and Trust Trust in online transactions remains a concern for many consumers. While digital payment systems are becoming more prevalent, there is still a significant reliance on cash transactions. Building consumer trust in online payments and ensuring secure transactions are critical for the growth of e-commerce.

- Regulatory and Legal Environment The regulatory environment for online business in Africa is still developing. Issues such as data protection, cybersecurity, and consumer rights need to be addressed to create a safe and conducive environment for online transactions. Governments and regulators are increasingly focusing on creating frameworks that support digital business while protecting consumers.

- Logistics and Delivery Logistics and delivery infrastructure can be a bottleneck for e-commerce businesses. Efficient and reliable delivery services are crucial for customer satisfaction and repeat business. Companies need to develop effective logistics strategies to ensure timely delivery and manage returns.

Artificial Intelligence in Africa: Unlocking a New Era of Innovation

Artificial Intelligence (AI) is rapidly transforming industries and societies across the globe. In Africa, the adoption of AI technologies presents a unique opportunity to address a wide range of challenges and accelerate development. From improving healthcare and education to driving economic growth, AI has the potential to revolutionize various sectors in the continent. This article explores the current state of AI in Africa, its potential applications, and the challenges and opportunities it presents.

The Current State of AI in Africa

AI is gaining momentum in Africa, with increasing investments, research initiatives, and startups emerging across the continent. Countries such as Nigeria, Kenya, South Africa, and Egypt are leading the way in AI development, leveraging their tech-savvy populations and burgeoning innovation ecosystems.

In recent years, African governments, academic institutions, and private enterprises have recognized the importance of AI and are investing in infrastructure, education, and research. For instance, South Africa's University of Pretoria has established the Centre for Artificial Intelligence Research (CAIR), which focuses on advancing AI technologies and their applications. Similarly, Nigeria's Data Science Nigeria is building a community of data scientists and AI practitioners.

Potential Applications of AI in Africa

- Healthcare AI can play a pivotal role in improving healthcare delivery in Africa. With a shortage of medical professionals and resources, AI-powered solutions can enhance diagnostics, patient monitoring, and treatment planning. For example, AI algorithms can analyze medical images to detect diseases like cancer and tuberculosis, allowing for early intervention. Telemedicine platforms powered by AI can also bridge the gap between patients and healthcare providers, especially in remote areas.

- Agriculture Agriculture is a cornerstone of many African economies, and AI can significantly enhance productivity and sustainability in this sector. AI-powered systems can analyze weather patterns, soil conditions, and crop health, providing farmers with actionable insights to optimize planting and harvesting. Drones equipped with AI can monitor crop fields and identify areas that require attention, reducing the need for manual labor.

- Education AI has the potential to transform education in Africa by providing personalized learning experiences and expanding access to quality education. AI-powered platforms can tailor educational content to individual students' needs, helping them learn at their own pace. Additionally, AI can assist in grading and providing feedback, allowing teachers to focus on more interactive and creative aspects of teaching.

- Financial Services The financial sector in Africa is rapidly adopting AI technologies to improve services and enhance customer experiences. AI-driven chatbots and virtual assistants can provide customer support and financial advice, making banking more accessible. AI algorithms can also analyze transaction data to detect fraud and assess creditworthiness, expanding financial inclusion for underserved populations.

- Smart Cities and Infrastructure As urbanization accelerates in Africa, AI can play a crucial role in developing smart cities and efficient infrastructure. AI-powered traffic management systems can optimize traffic flow and reduce congestion. Additionally, AI can be used to monitor and manage utilities such as water and electricity, ensuring efficient resource use.

Challenges and Opportunities

While AI holds immense promise for Africa, there are several challenges that need to be addressed to fully realize its potential:

- Access to Data: AI systems require large amounts of data to function effectively. However, data collection and availability can be limited in many African countries. Ensuring data privacy and security is also a concern.

- Skills Gap: There is a shortage of skilled professionals in AI and related fields in Africa. Investing in education and training programs is essential to build a robust talent pipeline.

- Infrastructure: Reliable internet connectivity and access to computing resources are critical for AI development. Improving digital infrastructure is a key challenge in many parts of the continent.

- Ethical and Regulatory Considerations: The deployment of AI raises ethical and regulatory questions, including issues related to bias, transparency, and accountability. Establishing clear guidelines and frameworks is essential for responsible AI use.

Despite these challenges, the opportunities for AI in Africa are vast. The continent's young and dynamic population, coupled with a growing tech ecosystem, positions Africa as a potential leader in AI innovation. By leveraging AI, African countries can address pressing challenges, drive economic growth, and improve the quality of life for their citizens.

The growing pains of e-commerce business in Africa

High cost of logistics is making it difficult for online platforms to survive

E-Commerce has long been touted as Africa’s next high-growth market. Several reasons are cited for the optimism, among them the continent’s large, relatively young, and tech-savvy population, increasing mobile internet penetration, a fast-growing middle-class and rising disposable income.

The burgeoning industry has seen the birth of homegrown e-commerce platforms such as Jumia (Nigeria), Takealot (South Africa) and Kilimall (Kenya), and the market’s potential has not gone unnoticed by bigger international players like Amazon, Alibaba, Shein and even Facebook, all of whom are positioning themselves for a piece of the e-commerce pie.

Africa, however, is a truly unique operating environment and presents its own challenges, from logistical constraints, underdeveloped infrastructure and limited payment gateways to security, access to capital and a customer trust deficit. The playing field, which is becoming increasingly crowded and putting pressure on margins and profitability, is ripe for both consolidation and disruption.

Of the continent’s e-commerce markets, South Africa, Nigeria, and Kenya are among the most advanced and offer valuable lessons to potential entrants and upstarts about how to overcome Africa’s idiosyncrasies, and what happens when you don’t.

E-Commerce in Africa

Africa’s e-commerce journey began when South African platforms - Kalahari.com and Bidorbuy.com - started out in 1998 and 1999 respectively at the height of the dotcom boom. Since those early days, e-commerce on the continent has grown exponentially. There are over 264 active e-commerce sites across 23 countries in Africa.[1] South Africa alone boasts overs 105 e-commerce platforms, while Kenya and Nigeria have 60 and 58 respectively (figure 1).

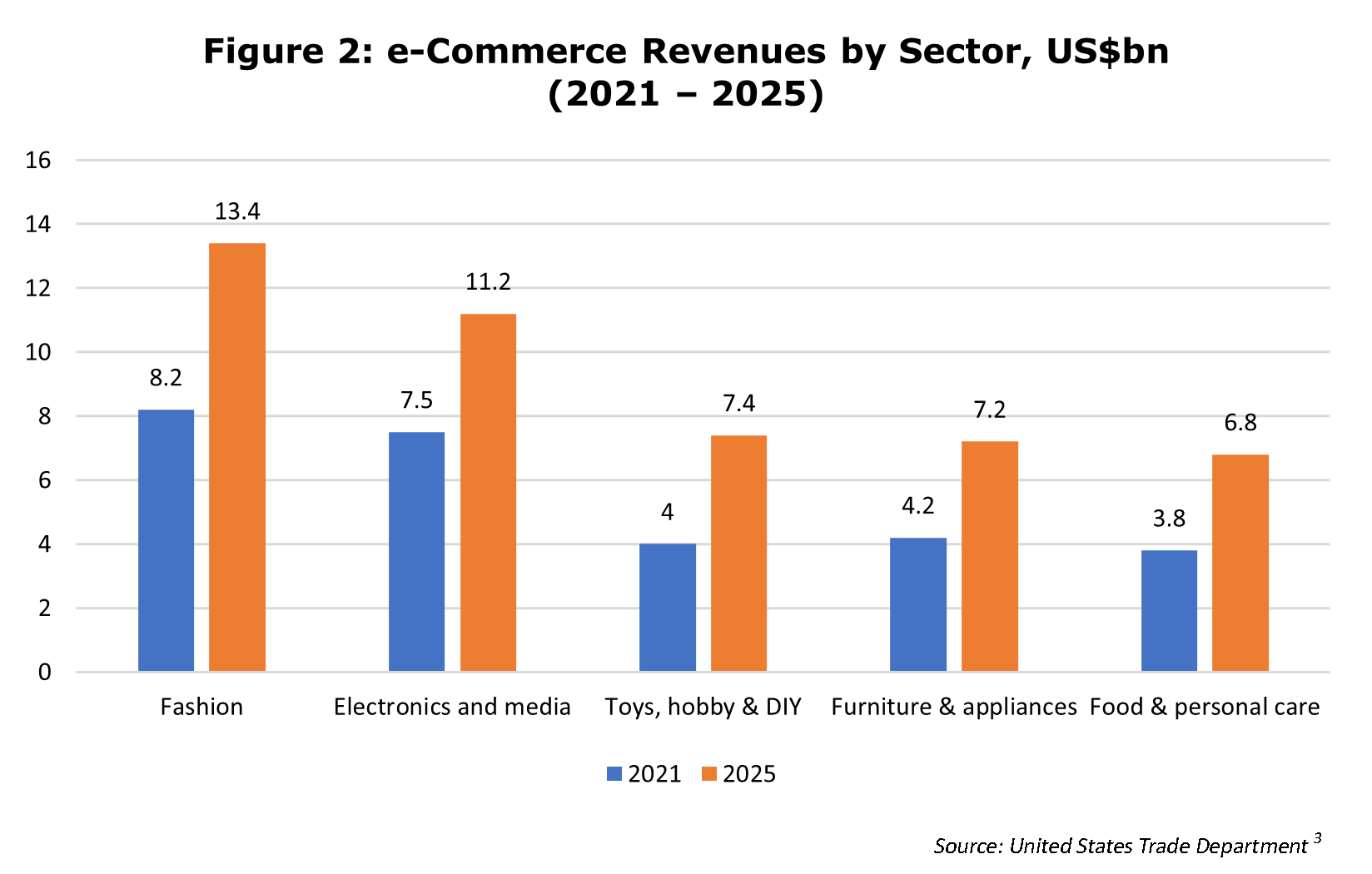

E-commerce sites have sprung up to cater to almost every consumer need - from food delivery services to everyday groceries. Data shows that in Africa fashion, electronics, and media are the biggest online spend categories. This is followed by toys, hobbies and DIY furniture. (figure 2).

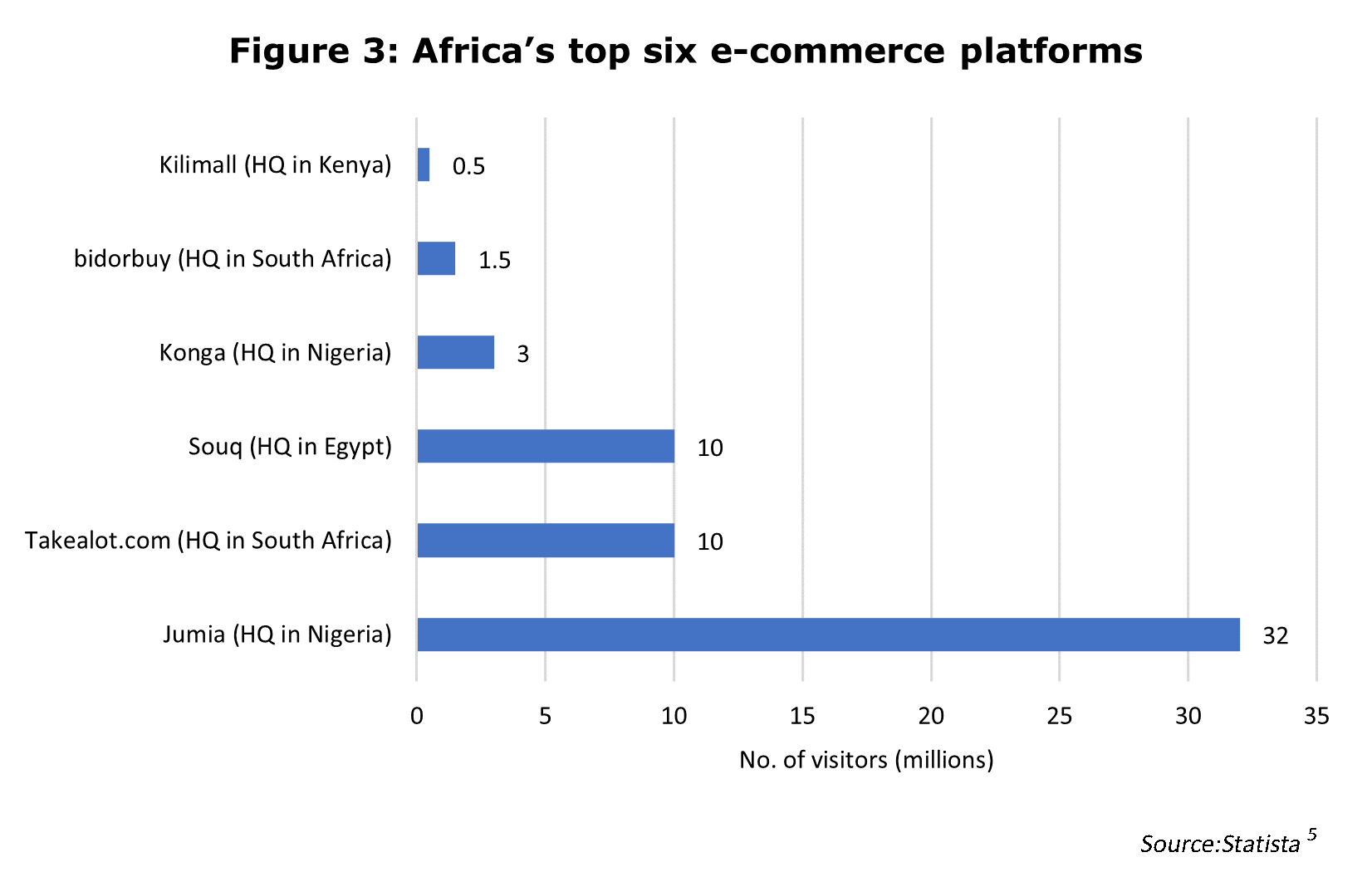

Africa’s biggest e-commerce website is Nigeria-based Jumia which attracts an average of over 32 million visitors a month, followed by South Africa’s Takealot and Egypt’s Souq[4]with 10 million unique visitors per month each.

Africa’s biggest e-commerce website is Nigeria-based Jumia which attracts an average of over 32 million visitors a month, followed by South Africa’s Takealot and Egypt’s Souq[4]with 10 million unique visitors per month each.

The e-commerce penetration rate in Africa is expected to breach the half-a-billion user mark by 2025 (40%), up from just 139 million users (13%) in 2017. That represents a compounded annual growth rate of 17% (figure 4).

The e-commerce penetration rate in Africa is expected to breach the half-a-billion user mark by 2025 (40%), up from just 139 million users (13%) in 2017. That represents a compounded annual growth rate of 17% (figure 4).

Notably, most of the e-commerce traffic comes from mobile devices – more than 70%. It is expected to be almost exclusively mobile by 2040.[7]The 281 million currently active online shoppers in Africa[8]are forecast to drive revenue to US$49bn in 2023 and to US$82bn in 2027[9] (figure 5).

From a growth perspective, Africa’s e-commerce story is a compelling one. But from the profitability point of view it is still a long way from maturity. Despite the double-digit revenue advance since 2017, Africa makes up less than 1% of the US$6.3tn global e-commerce economy. While the expansion of mobile telecommunication networks, uptake of smart devices, rising disposable income and large population are big drivers of online commerce growth, they don’t tell the full story. A 2017 report by Disrupt Africa found that less than 30% of Africa’s e-commerce start-ups were profitable.[11] The lack of profitability is not limited to start-ups, however. Many of the biggest e-commerce companies on the continent have not yet turned a profit after more than a decade of trading, surviving only on capital injections from venture funders or parent companies. Nigeria’s Jumia, South Africa’s Takealot and Kenya’s Kilimall, all leaders in their respective countries, offer valuable insight into the challenges of turning an e-commerce profit in Africa.

From a growth perspective, Africa’s e-commerce story is a compelling one. But from the profitability point of view it is still a long way from maturity. Despite the double-digit revenue advance since 2017, Africa makes up less than 1% of the US$6.3tn global e-commerce economy. While the expansion of mobile telecommunication networks, uptake of smart devices, rising disposable income and large population are big drivers of online commerce growth, they don’t tell the full story. A 2017 report by Disrupt Africa found that less than 30% of Africa’s e-commerce start-ups were profitable.[11] The lack of profitability is not limited to start-ups, however. Many of the biggest e-commerce companies on the continent have not yet turned a profit after more than a decade of trading, surviving only on capital injections from venture funders or parent companies. Nigeria’s Jumia, South Africa’s Takealot and Kenya’s Kilimall, all leaders in their respective countries, offer valuable insight into the challenges of turning an e-commerce profit in Africa.

Jumia – Nigeria

Jumia, once dubbed the “Amazon of Africa”, was arguably the continent’s most celebrated start-up and the first ‘unicorn’ (a startup whose market valuation hits US$1bn). It operates across 10 African countries selling everything from electronics to homeware, fashion, and groceries. More recently, it has expanded into logistics, hotel and travel booking, food delivery and payment services.

The firm, which is headquartered in Berlin, and whose senior leadership and software developers operate from Dubai and Portugal respectively, was launched in 2012 in Nigeria as an African company with the financial backing of German venture capital firm, Rocket Internet and South African mobile telecommunications company, MTN. In 2019, Jumia listed on the New York Stock Exchange[12] raising US$196m.[13] But since the IPO, which saw the share soar threefold from its listing price ($US14.50), the stock has fallen more than 90% from its all-time high (of US$62 in February 2021), and now trades below US$3.[14] Rocket Internet and MTN have both since divested their holdings the company has faced a barrage of questions from members of the media and public at large. They have had to defend their claims of being an African firm and counter accusations of fraud. Jumia has never turned a profit. In 2022 it reported losing as much as US$227m.[15] To put the firm back on a path to profitability a new management was brought in. Operations in four of its 14 markets were wound up[16] and 20% (900 people) of its workforce was laid off.[17]

Operational and management issues aside, Africa is a difficult place to do business. Jumia’s 2019 annual report shows that the company’s fulfilment expenses (cost to ship and deliver orders) were US$1.6m higher than its gross profit. Managing logistics in Africa is particularly challenging. Informal spatial and suburban planning in many areas make precise delivery addresses difficult to identify. That can result in failed deliveries, order cancellations and returns, which for Jumia, are as high at 20%. The remoteness of some delivery areas as well as underdeveloped road infrastructure have meant that the company has had to adapt its delivery methods, which include bicycles, roller-skates, and more recently, drones.[18] This creates additional layers of complexity and adds costs to what is already an expensive business model that works on thin margins.

While Jumia’s balance sheet remains relatively free of debt it has only US$228m in cash reserves left. At its current burn rate Jumia may have only a year worth of runway before having to raise debt or issue shares, neither of which is likely to be well received by investors.

Online retailers are cash hungry, requiring enormous scale before becoming profitable. South Africa’s Takealot is another example of an African e-commerce leader yet to make a profit.

Takealot – South Africa

Takealot was officially launched in 2011 after US based investment firm, Tiger Global Management[19] acquired and rebranded Take2, a South African e-commerce player founded in 2002.[20] In 2014, the company merged its operations with Naspers-owned Kalahari.com, which at the time, was a market leader in online sales of games, books, music, DVDs, cameras, and electronics in South Africa.

In the announcement of their merger, Takealot acknowledged that without scale “SA retailers simply can’t compete successfully against the local brick and mortar retailers and foreign companies such as Amazon and Alibaba.[21]” At the time, both Kalahari and Takealot were loss-making.[22] To add greater scale and logistics capabilities to the business, Naspers completed a full buyout of Takealot in 2018 grouping it with online clothing retailer, Superbalist and Food Delivery business, Mr D Food.

Despite accounting for half of South Africa’s online purchases, Takealot incurred a US$13m trading loss in the six months to June 2022 on sales of US$384m. Like Jumia, rising logistical costs and complexity are one of the reasons the company has yet to turn a corner. A weaker exchange rate, higher inflation, rising interest rates and pressure on disposable income have been a blow to both sales and operating expenses.

The group’s latest loss comes at a time when Amazon is readying to enter the South African market, and brick and mortar retailers are fighting back with their own delivery platforms. The country’s biggest retailers, Checkers (Sixy60), Woolworths (Woolies Dash), Pick ‘n Pay (PnP Express), Makro / Walmart and Mr Price among many others have all launched e-commerce platforms that leverage their existing store infrastructure across the country, allowing same-day delivery. To compete, Takealot has had to invest substantially in additional warehousing, inventory, and distribution centres, pushing out its breakeven timeframe.

Nevertheless, the runway for Takealot is decidedly longer. Despite multiple cash injections of hundreds of millions of dollars, Takealot’s parent firm, Naspers, has deep pockets and is intent on staying the course.[23]

Kilimall – Kenya

Nairobi based Kilimall has styled itself as a marketplace rather than a true e-commerce retailer. It is a relatively new entrant to Africa’s e-commerce space, having launched in 2014. It is the second biggest e-commerce platform in Kenya after Jumia and was founded by ex-Huawei employee Yang Tao who started the firm in response to his frustration at the limited range and high cost of goods in Kenya. Kilimall is for all intents and purposes is a Chinese company that was started in Kenya to offer small businesses a way to sell their products to Kenya’s growing digital shopping market. It has since grown to over 10,000 sellers from both Africa and China[24], and exports Kenyan products to Chinese buyers. The e-commerce platform also offers an online payment system, Lipapay, and logistics system KillExpress. The firm’s strong connection with the world’s biggest manufacturing hub are seen as a distinct competitive advantage. While a great deal less is known about Kilimall, its ownership structure and trading performance (purportedly as high as US$72m in sales annually[25]), the company has faced a wave of complaints about the poor customer service, quality of its products or orders not being delivered at all.

Kilimall’s expansion into Uganda and Nigeria was short-lived. Barely two years after launching in Kampala in 2016 it decided to exit. Talks with private investors to sell out the Ugandan unit collapsed, leaving rival Jumia with an 80%[26] market share in the country.[27] Ironically, months before exiting Uganda, founder and CEO announced plans to be present in all African countries by 2022.[28]Kilimall’s Nigerian domain too, has been shuttered.

The experiences of Jumia, Takealot and Kilimall highlight the challenges faced by e-commerce players in Africa, but also the industry more broadly. They also suggest that the excitement around e-commerce in Africa belies the difficult trading conditions on the continent and lack of profitability. There is a multitude of challenges to navigate just to complete a sale, let alone fulfil the order and make a profit in the process.

Internet connectivity and the cost of data

Poor internet connectivity and the high cost of data are less of an issue than they have been in the past but are nevertheless an inhibitor to faster and broader adoption of mobile browsing and conversion to sale. While data costs have eased over the past 5 years, Africans still spend a disproportionately high amount of their average monthly income on connectivity (figure 6).

E-commerce sites in Africa (as with the rest of the world) have been optimised for mobile browsing and low data consumption but true progress will only be achieved through regulatory reform that force data costs lower and the wider roll-out of free wi-fi in public areas.

In South Africa, mobile telecommunications providers have lowered exorbitant data costs under pressure from government and the public, even “zero-rating” certain government, educational and employment websites, where browsing does not use the customers data. Instead, zero-rated sites are effectively subsidised and paid for by the zero-rated site owners.[30] Considering how few e-commerce platforms in Africa are profitable, it is difficult to see how they would be able to carry the cost of zero-rating, and whether the cost would be more than offset by sale conversions. Nevertheless, e-commerce platforms will have to become more creative in attracting and converting site visits in a data-constrained environment.

Payments and the trust deficit

Given Africa’s large unbanked population, many consumers either operate on a cash basis (often outside the formal economy) or rely on mobile money and digital wallets. At just 31.5%, Africa has the lowest proportion of adults with a bank account anywhere in the world. The continent does, however, have the highest proportion of its adult population with a mobile money account globally (22.5%) (figure 7).

The Challenges of Marketing in Africa

The astronomical growth in online activity in Africa – and the potential for digital marketing – can’t be ignored. For all those interested in marketing in Africa, you need to know what’s happening on the continent.

Digital media marketing in emerging markets, particularly Africa, is a challenge. The development of agencies and client management in digital marketing are not as clear-cut on the continent as it is in the Western world. Digital marketing is by no means mature in the region yet and often lack consistent processes, clearly defined goals, consistent, clear messaging and a clearly defined – and understood – target audience.

There are factors one need to consider when undertaking marketing projects in the region, elements you might not even know exist or consider in other areas of the world. Economies, socio-political intricacies, language barriers, multiple currencies and regional conflicts will all count against you if you are working in a digital marketing agency or as a digital expert with a focus on Africa.

Africa comprises 54 countries, with over 2 000 living or spoken languages (522 in Nigeria alone!). And, if the statistical growth of active online users is anything to go by, the continent is on the cusp of a digital revolution.

We’ve “run the numbers” and the continent is opening up for digital marketing agencies in a big way.

However, successful marketing is one of the most challenging (and underestimated) aspects of businesses new and old. And the question is, how do you go about marketing in Africa?

There are a great many marginalised communities that need specific attention and information regarding services or products that you will need to reach. But it’s not as simple as putting up billboards with over 2 000 living or spoken languages (522 in Nigeria alone!). And, if the statistical growth of active online users is anything to go by, the continent is on the cusp of a digital revolution

So let’s have a look at what the numbers are saying.

The third wave of ecommerce in Africa:

This first phase of ecommerce startups in Africa caused many to question the viability of ecommerce on the continent, but improving market conditions, the necessity for ecommerce, and the huge potential market size made up of a large population of people under 40 led many to keep trying, in hopes of attaining some level of success.

By the late 2010s, the return of investors’ interest in ecommerce took a different direction as they focused on companies that are digitising retail distribution, such as Wasoko (formerly Sokowatch), Marketforce, Trade Depot, Alerzo, and Omnibiz. The logic behind this was simple: Informal retailers are responsible for 90% of retail transactions in Africa, and 80% of fast-moving consumer goods (FMCGs) to African households. These startups began to bring order to the uncoordinated, fragmented, and unstructured informal retail sector.

Coding In Africa: An essential skill of the future

Coding promotes innovation for the future.

Coding is essential in South Africa as it helps with the innovation of new ideas. This is according to Lebo Miya, MD of Ekasi Code Club, a company that focuses on taking unemployed youth and turning them into employed junior developers.

"Coding is important for South Africa because it provides people with an opportunity to innovate and create new things which are unique to the South African context.

"From new tech businesses to social entrepreneurship solutions, coding really allows people to become masters of content, creating as well as consuming." Miya said.

"Access to opportunity is currently the biggest problem faced by local coders. Many people are hindered in their endeavours by either not having a reliable/up to specs devices to work on, or Internet capabilities being lacklustre. We also don't really provide enough educational material around code and the doors it can open."

The third wave of ecommerce in Africa

It’s 2:00 p.m. in Accra, Ghana. Efua has just received her kanga outfit which she bought from a Kenyan ecommerce store. She tries out the loose-fitting red-and-yellow-patterned dress and looks at herself in the mirror. The dress fits perfectly.

Efua shares a picture of herself with her friends of her wearing the dress, anticipating their response. She also heads over to Instagram to say thank you to the vendor, Barika, who, upon seeing the message, is relieved her customer is pleased.

Barika, who’s been selling online for three years to supplement her income from her nine-to-five job, is elated at the seamless transaction that has happened. The payment was handled by a fintech company that helped change Efua’s Ghanaian cedis to Kenyan shillings, all at a low cost; the shipping and delivery of the kanga outfit was done by a logistics service provider at a tiny fraction of the dress’ cost.

This particular transaction reminds Barika of how she prefers her business transactions to take place. She wishes for no delays in delivery, no trust issues with customers, and no failed payments.

The promise and hope of many Africans and ecommerce startups are that ecommerce would operate seamlessly, exactly like the fictional story you just read. But over the past decade, the African ecommerce space, which is faced with numerous challenges, has evolved, with many startups launching and shutting down across the continent.

It’s noteworthy that while the bar for entry in the world of ecommerce is low, meaning almost anyone with a smartphone and internet access can set up an ecommerce store, many players in that space have struggled with growth and strategic priorities.

Why is this the case, and what opportunities exist for players in the ecommerce space who are on the journey to fulfilling the hopes of many Africans?

The internet is redesigning commerce

The evolution of commerce in Africa has come a long way from the era of trade by barter to the current era of ecommerce which began globally in the 1990s due to the proliferation of consumer internet and electronic payments.

While the ecommerce behemoths, eBay and Amazon, launched in 1995, Africa’s ecommerce boom didn’t happen until almost two decades later, in the early 2010s, when African ecommerce startups such as Jumia, Konga, and Takealot.com emerged. They were fuelled by an early venture capital boom and mainly emulated Western business models.

Between 2012 and 2015, Jumia, Zando, Takealot.com, and Konga raised over $855 million. In 2014, Jumia raised $150 million, more than half of what the entire African tech ecosystem raised the following year.

Heralded as the next Amazons of Africa, these startups faced a large swath of difficulties that eventually led to the demise of many of them. Between 2017 and 2019, prominent startups such as Dealday, Efritin, OLX, and Konga retrenched, reorganised, or closed down.

The optimism about ecommerce in Africa clouded some obvious challenges operators faced on the continent. They had to deal with the reality of a small addressable middle-class market, a lack of functional addressing systems, poor road networks, a general preference for cash payments, the lack of payment rails and logistics networks, worries about fake products, and escalating security concerns—uphill battles African ecommerce companies are still fighting to this day.

This first phase of ecommerce startups in Africa caused many to question the viability of ecommerce on the continent, but improving market conditions, the necessity for ecommerce, and the huge potential market size made up of a large population of people under 40 led many to keep trying, in hopes of attaining some level of success.

By the late 2010s, the return of investors’ interest in ecommerce took a different direction as they focused on companies that are digitising retail distribution, such as Wasoko (formerly Sokowatch), Marketforce, Trade Depot, Alerzo, and Omnibiz. The logic behind this was simple: Informal retailers are responsible for 90% of retail transactions in Africa, and 80% of fast-moving consumer goods (FMCGs) to African households. These startups began to bring order to the uncoordinated, fragmented, and unstructured informal retail sector.

More recently, there’s been a third wave of ecommerce startups that are digitising offline commerce for restaurants and mom-and-pop shops by providing them with tools to enable them to come online and do more. In 2020, Flutterwave, Interswitch, and Paystack launched their ecommerce solutions. Startups like Orda, Kippa, and Sabi, founded within the last three years, also provide ecommerce enablement tools.

Apparently, African ecommerce players have moved on from imitating Western startups, and they’re finding their feet and solving the continent’s problem.

The penetration of ecommerce into Africa has also risen from 13% in 2017, according to the Statista Digital Market Outlook, to 28%, or a total ecommerce user number of 334 million in 2021. All this has been bolstered by an increase in payment services, penetration of the internet in the continent, and the proliferation of cheap smartphones.

The evolution of Marketing in Africa

I listen to a podcast by Reid Hoffman (Co-founder of LinkedIn and Paypal) on most mornings in the gym and on my way to work. I have found much inspiration in the stories he shares as he has interviewed a number of global leaders (Mark Zuckerberg, Sheryl Sandberg, Stewart Butterfield e.t.c.). One key theme that resonates with all the people he talks to is a theme he terms “infinite learning”. My take on this is the process by which human beings are capable of finding a problem, learning to solve it, mastering it then break everything down again to start from the beginning to rebuild the solution. It is part scary and partially exhilarating.

We live in exciting times where the sands are shifting faster than our feet can move. In the past, marketing depended on broadcast methodologies to reach as many consumers as possible and therefore create proportional demand. Consumers relied on the broadcast channels and trusted what they were told. Those were simpler times. Currently, consumers exist in almost incalculable segments with such detailed differentiation that, variations the time and place at which the consumer is engaged make a difference. It is currently not enough of an effort to simply broadcast messages in the hope that consumers will see it and respond. Brands need to put in more effort to engage. This sounds like a lot of work, if traditional methodology is used.

Fortunately, developments in technology have created tools and techniques that simplify the process of consumer engagement. Consumer engagement has replaced simply broadcasting information. Research, data collection and interpretation have made it possible to predict degrees of success for different brands and products. We can now personalize messages for segments based on critical relevant insights rather than gut feelings. In many ways, this requires many marketers to completely rethink their approach to communications. It requires smart insights generated from data and consistent analysis. The internet allows consumers to find information for themselves. Consumers now value experiences and values shared with brands more.

The future of marketing lies not in integration, but, in shifting the focus to digital oriented, consumer centric marketing, from the brief to the report. Research companies are also feeling the pinch with the realization that their data collection and analysis business model requires a revamp. They are costly, not always efficient and inaccurate at times. A new approach to marketing requires an understanding of relevant digital tools (many are invented daily but not all are relevant) to mine insights, a wholistic understanding of consumer characteristics and courage.

I’m taking on infinite learning. My specific approach is to learn how to understand my audience even better using relevant tools and the timeless principle of seeking a win-win solution for brands and consumers. The future looks exciting.